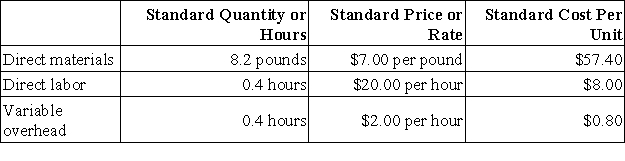

Galla Corporation makes a product with the following standard costs:  The company budgeted for production of 2,400 units in June, but actual production was 2,500 units. The company used 19,850 pounds of direct material and 980 direct labor-hours to produce this output. The company purchased 21,700 pounds of the direct material at $6.70 per pound. The actual direct labor rate was $19.20 per hour and the actual variable overhead rate was $1.80 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The company budgeted for production of 2,400 units in June, but actual production was 2,500 units. The company used 19,850 pounds of direct material and 980 direct labor-hours to produce this output. The company purchased 21,700 pounds of the direct material at $6.70 per pound. The actual direct labor rate was $19.20 per hour and the actual variable overhead rate was $1.80 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The materials price variance for June is:

Definitions:

Plant Assets

Physical resources that are owned and used by a business and are permanent or have a long life; long-term or relatively permanent tangible assets such as equipment, machinery, and buildings that are used in normal business operations.

Decentralization

The distribution of decision-making power away from a central authority, allowing for greater autonomy at lower levels of an organization.

Authority

The power or right to give orders, make decisions, and enforce obedience.

Support Department Allocation Rates

Ratios or percentages used to distribute the costs of support departments to producing or service departments based on agreed-upon methods.

Q7: Because absorption costing emphasizes costs by behavior,

Q52: May Corporation, a merchandising firm, has budgeted

Q53: The selling and administrative expense budget of

Q57: The direct labor budget is based on:<br>A)the

Q59: The Jenkins Division recorded operating data as

Q81: The Portland Division's operating data for the

Q95: Dilbert Farm Supply is located in a

Q104: Routsong Corporation had the following sales and

Q176: Aaker Corporation, which has only one product,

Q244: Gandrud Kennel uses tenant-days as its measure