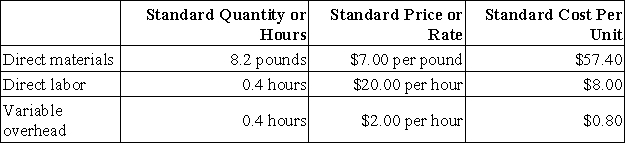

Galla Corporation makes a product with the following standard costs:  The company budgeted for production of 2,400 units in June, but actual production was 2,500 units. The company used 19,850 pounds of direct material and 980 direct labor-hours to produce this output. The company purchased 21,700 pounds of the direct material at $6.70 per pound. The actual direct labor rate was $19.20 per hour and the actual variable overhead rate was $1.80 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The company budgeted for production of 2,400 units in June, but actual production was 2,500 units. The company used 19,850 pounds of direct material and 980 direct labor-hours to produce this output. The company purchased 21,700 pounds of the direct material at $6.70 per pound. The actual direct labor rate was $19.20 per hour and the actual variable overhead rate was $1.80 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for June is:

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset since it was acquired and placed into service.

Balance Sheet

is a financial statement that provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and equity.

Income Statement

A report that outlines a business's financial activities, including income, expenses, and overall profit or loss, for a set period.

Financial Statements

Comprehensive reports created from a company's accounting data, intended to present the financial performance and position of the company.

Q18: The Jenkins Division recorded operating data as

Q60: Cutterski Corporation manufactures a propeller. Shown below

Q100: The cash budget is typically prepared before

Q105: Brandon Inc., has provided the following data

Q110: The following information was taken from the

Q110: Gough Corporation has two divisions: Domestic and

Q149: Meyer Corporation has two sales areas: North

Q155: Privett Hospital bases its budgets on patient-visits.

Q165: The manufacturing overhead budget of Paparella Corporation

Q202: Lartey Corporation's cost formula for its selling