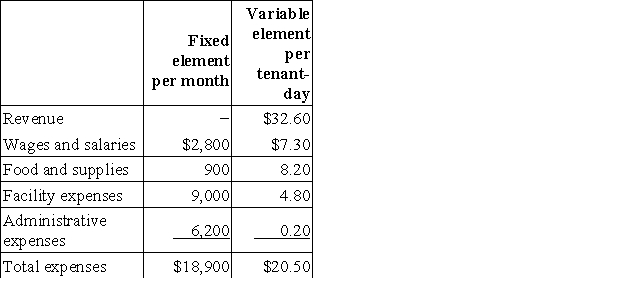

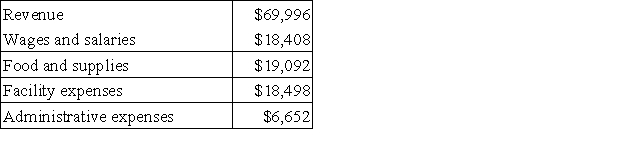

Perla Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During March, the kennel budgeted for 2,200 tenant-days, but its actual level of activity was 2,160 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for March: Data used in budgeting:  Actual results for March:

Actual results for March:  The wages and salaries in the planning budget for March would be closest to:

The wages and salaries in the planning budget for March would be closest to:

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset since it was acquired.

Gain Or Loss

The financial result that occurs when the selling price of an asset differs from its purchase price.

Initial Cost

The initial expense of acquiring an asset, including purchase price, setup, and preparation costs.

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated to depreciation expense since the asset was put into use.

Q22: Under absorption costing, it is possible to

Q35: Starg Corporation, a retailer, plans to sell

Q46: Jackson Industries uses a standard cost system

Q49: The manufacturing overhead budget at Pendley Corporation

Q85: Wesolick Clinic uses client-visits as its measure

Q123: Ragins Corporation produces a single product and

Q138: A manufacturing company that produces a single

Q140: The LFG Corporation makes and sells a

Q293: Hagel Clinic uses client-visits as its measure

Q413: Payeur Corporation uses customers served as its