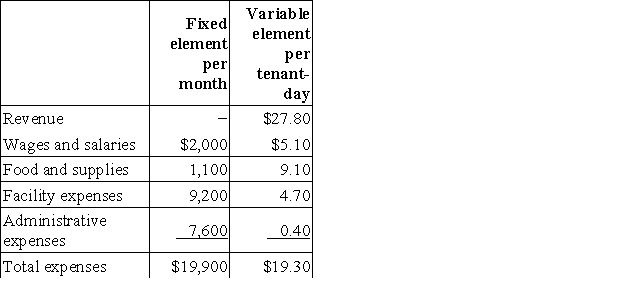

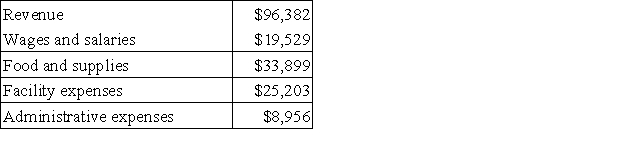

Smithj Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During February, the kennel budgeted for 3,500 tenant-days, but its actual level of activity was 3,490 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for February: Data used in budgeting:  Actual results for February:

Actual results for February:  The spending variance for facility expenses in February would be closest to:

The spending variance for facility expenses in February would be closest to:

Definitions:

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

ABC

A method of identifying and assigning costs to specific activities to improve cost accuracy and managerial decision-making.

Special Materials

Materials that are uncommon, difficult to procure, or used in specialized applications.

Activity-Based Costing

An accounting method that assigns costs to products and services based on the resources they consume and the activities they require.

Q21: Berends Corporation makes a product with the

Q50: The North Division of the Lyman Company

Q146: In business, a budget is a method

Q147: Noel Enterprises has budgeted sales in units

Q150: George Corporation has no beginning inventory and

Q167: Carter Lumber sells lumber and general building

Q173: Branner Corporation uses customers served as its

Q183: Graybeal Corporation makes a product with the

Q288: Hartz Urban Diner is a charity supported

Q361: Kari Kennel uses tenant-days as its measure