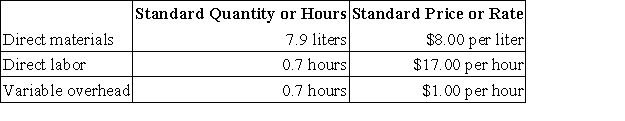

Ortman Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in May.

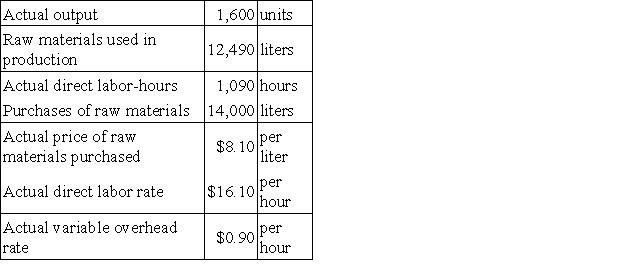

The company reported the following results concerning this product in May.  The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials price variance for May is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials price variance for May is:

Definitions:

Interest Rates

The percentage of a sum of money charged for its use, typically expressed as an annual percentage rate.

Par Value

The face or nominal value of a bond, stock share, or coupon, as specified by the issuer.

Coupon Rate

Annually, the interest earned on a bond represented as a percentage of its face value.

Premium Bond

Bond prices and interest rates are inversely related; that is, they tend to move in the opposite direction from each other. A fixed-rate bond will sell at par when its coupon interest rate is equal to the going rate of interest, rd. When the going rate of interest is above the coupon rate, a fixed rate bond will sell at a “discount” below its par value. If current interest rates are below the coupon rate, a fixed rate bond will sell at a “premium” above its par value.

Q57: The direct labor budget is based on:<br>A)the

Q76: During May, Cockrel Corporation plans to serve

Q110: When used in return on investment (ROI)

Q123: Ragins Corporation produces a single product and

Q124: Chirico Clinic uses client-visits as its measure

Q168: Trumbull Corporation budgeted sales on account of

Q193: The variable overhead efficiency variance measures how

Q204: The following data pertain to last year's

Q251: Beakins Corporation produces a single product. The

Q273: The following materials standards have been established