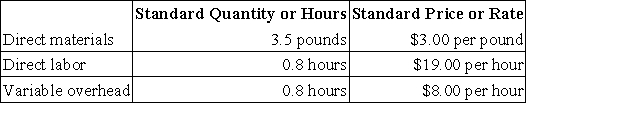

Epley Corporation makes a product with the following standard costs:  In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The materials quantity variance for July is:

Definitions:

Market Price

The current price at which an asset or service can be bought or sold.

Variable Cost Concept

The principle stating that costs change in proportion to changes in volume of activity or production.

Cost-Plus Approach

A pricing strategy where the selling price is determined by adding a specific markup to a product's cost price to cover overheads and profit.

Markup

The amount added to the cost of a product or service to arrive at a selling price.

Q33: Chow Corporation manufactures children's chairs made of

Q37: Zabarkes Corporation is considering a capital budgeting

Q117: Riveros, Inc., is considering the purchase of

Q125: Harris Corporation produces a single product. Last

Q178: Bard Hotel bases its budgets on guest-days.

Q211: Pevy Corporation has two divisions: Southern Division

Q233: Ortman Corporation makes a product with the

Q253: Kudej Printing uses two measures of activity,

Q307: Wall Corporation, which produces commercial safes, has

Q372: Paye Clinic uses patient-visits as its measure