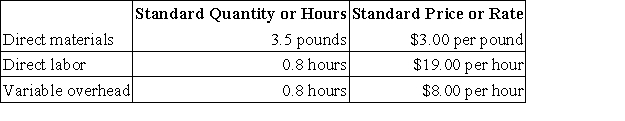

Epley Corporation makes a product with the following standard costs:  In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for July is:

Definitions:

Accounts Payable

Obligations a company has to pay back to lenders for products and services bought on credit.

Salary Expense

The total amount paid to employees for services rendered during a specific period before any deductions are made.

Fees Earned

Revenue generated from services provided.

Common Stock

A kind of stock that signifies having a stake in a company, accompanying the power to vote and the possibility of receiving dividends.

Q16: The Jenkins Division recorded operating data as

Q20: Stewart Corporation makes a product with the

Q103: Poriss Corporation makes and sells a single

Q113: Qabar Corporation, which has only one product,

Q120: Dilbert Farm Supply is located in a

Q124: Chirico Clinic uses client-visits as its measure

Q130: A revenue variance is favorable if the

Q161: Sioux Corporation is estimating the following sales

Q218: Ohme Framing's cost formula for its supplies

Q326: Coody Clinic uses patient-visits as its measure