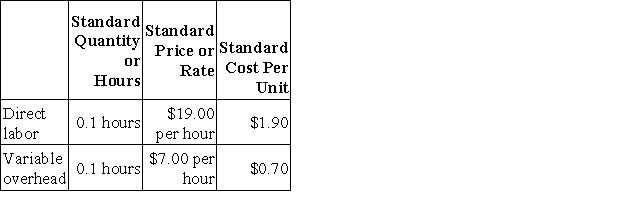

Desue Corporation makes a product with the following standards for labor and variable overhead:  The company budgeted for production of 6,500 units in December, but actual production was 6,300 units. The company used 610 direct labor-hours to produce this output. The actual variable overhead rate was $6.40 per hour. The company applies variable overhead on the basis of direct labor-hours. The variable overhead rate variance for December is:

The company budgeted for production of 6,500 units in December, but actual production was 6,300 units. The company used 610 direct labor-hours to produce this output. The actual variable overhead rate was $6.40 per hour. The company applies variable overhead on the basis of direct labor-hours. The variable overhead rate variance for December is:

Definitions:

Manufacturing Overhead

All manufacturing costs that are not directly involved in the production of a product, including indirect materials, indirect labor, and other indirect costs.

Credit Balance

The amount of money that a company or individual has in their account, indicating that they have received more money than they have spent.

Overapplied

A situation where the allocated overhead costs for a product or service exceed the actual overhead costs incurred.

Applying Overhead

The process of allocating indirect manufacturing costs to produced goods based on established criteria.

Q3: A direct materials quantity standard generally includes

Q34: Last year the Uptown Division of Gorcen

Q72: Longview Hospital performs blood tests in its

Q106: The Gerald Corporation makes and sells a

Q111: Aguilera Industries is a division of a

Q166: The Gerald Corporation makes and sells a

Q180: Meyer Corporation has two sales areas: North

Q183: Graybeal Corporation makes a product with the

Q362: Coderre Corporation manufactures and sells a single

Q374: A spending variance is the difference between