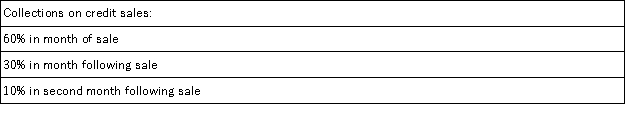

Richards Corporation has the following budgeted sales for the first half of next year:  The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:  The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. The total cash collected during January would be:

The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. The total cash collected during January would be:

Definitions:

Q29: Ortman Corporation makes a product with the

Q41: Crow Corporation produces a single product and

Q46: A tile manufacturer has supplied the following

Q53: Under absorption costing, fixed manufacturing overhead is

Q58: Canevari Corporation makes a product that uses

Q91: Morganti Corporation sells a product for $140

Q106: Poljak Tech is a for-profit vocational school.

Q117: Epley Corporation makes a product with the

Q118: Sales in North Corporation increased from $60,000

Q361: Kari Kennel uses tenant-days as its measure