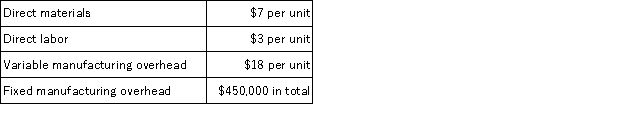

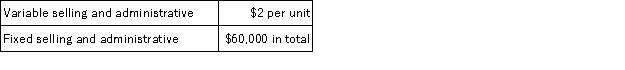

During its first year of operations, Carlos Manufacturing Corporation incurred the following costs to produce 8,000 units of its only product:  The company also incurred the following costs in selling 7,500 units of product during its first year:

The company also incurred the following costs in selling 7,500 units of product during its first year:  Assume that direct labor is a variable cost. Under absorption costing, what is the total cost that would be assigned to Carlos' finished goods inventory at the end of the first year of operations?

Assume that direct labor is a variable cost. Under absorption costing, what is the total cost that would be assigned to Carlos' finished goods inventory at the end of the first year of operations?

Definitions:

Decision

The process or action of choosing among alternatives, often based on analysis and information to achieve a desired goal.

Overtime

Extra hours worked beyond the regular working schedule, often compensated at a higher pay rate.

Production Constraint

A limitation or bottleneck in the production process that restricts output, efficiency, or the utilization of resources.

Profits

The financial gain achieved when the revenues from business operations exceed the expenses, costs, and taxes involved in sustaining the operation.

Q26: Lagana Corporation uses process costing. The following

Q40: Higgins Corporation sells three products, Product A,

Q44: Data concerning Sumter Corporation's single product appear

Q58: Canevari Corporation makes a product that uses

Q62: Rede Inc. manufactures a single product. Variable

Q102: Valley Manufacturing Corporation's beginning work in process

Q122: Aaker Corporation, which has only one product,

Q130: Budgets are used to plan and to

Q153: Mutskic Corporation produces and sells Product BetaC.

Q165: Iancu Corporation, which has only one product,