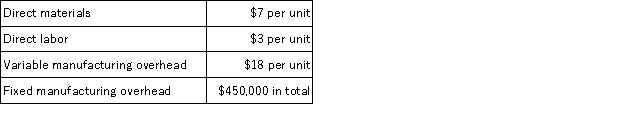

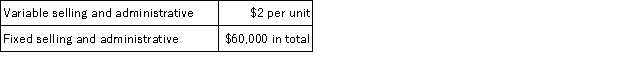

During its first year of operations, Carlos Manufacturing Corporation incurred the following costs to produce 8,000 units of its only product:  The company also incurred the following costs in selling 7,500 units of product during its first year:

The company also incurred the following costs in selling 7,500 units of product during its first year:  Assume that direct labor is a variable cost. If Carlos' absorption costing net operating income for this first year is $118,125, what would its variable costing net operating income be for this first year?

Assume that direct labor is a variable cost. If Carlos' absorption costing net operating income for this first year is $118,125, what would its variable costing net operating income be for this first year?

Definitions:

Incremental Cost

The additional cost that arises from producing one more unit of a good or service.

Cash Flows

The inflows and outflows of cash and cash equivalents, representing the operational, investing, and financing activities of a business.

Post-audit

The evaluation process conducted after a project's completion to assess its actual performance against planned objectives and costs.

Accounting Rate of Return

A financial metric that measures the return on investment expected from a project or asset, calculated as the average annual profit divided by the initial investment cost.

Q6: Jeanlouis, Inc., manufactures and sells two products:

Q24: Acklac Corporation uses the weighted-average method in

Q35: Bohlen Corporation produces and sells a single

Q62: Eliezrie Corporation makes a product with the

Q90: In December, one of the processing departments

Q140: A manufacturer of cedar shingles has supplied

Q142: Bracamonte Hospital bases its budgets on patient-visits.

Q167: Carter Lumber sells lumber and general building

Q173: Branner Corporation uses customers served as its

Q198: Roskos Corporation has two divisions: Town Division