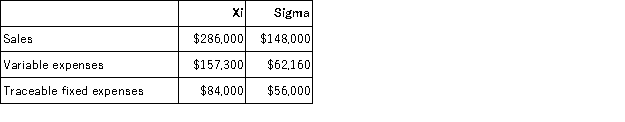

Waltz Corporation has two divisions: Xi and Sigma. Data from the most recent month appear below:  The company's common fixed expenses total $65,100. The break-even in sales dollars for Sigma Division is closest to:

The company's common fixed expenses total $65,100. The break-even in sales dollars for Sigma Division is closest to:

Definitions:

Actual Overhead

The real incurred costs relating to overhead during a specified accounting period, which could vary from budgeted or standard overhead costs.

Applied Manufacturing Overhead

The allocation of manufacturing overhead costs to individual units of production, based on a predetermined rate or basis.

Overapplied Overhead

A situation where the allocated manufacturing overhead costs for a period exceed the actual overhead costs incurred, indicating a discrepancy in costing or budgeting.

Underapplied Overhead

A situation where the actual manufacturing overhead costs are higher than the allocated costs during a period.

Q14: Callicott Corporation produces a product that sells

Q27: Last year, Rochester Corporation's variable costing net

Q72: Farron Corporation, which has only one product,

Q97: Peterson Corporation produces a single product. Data

Q100: Barker Corporation uses the weighted-average method in

Q148: Which of the following budgets are prepared

Q151: Johnston Corporation manufactures a single product that

Q188: The plant manager's work is an example

Q232: Kudej Printing uses two measures of activity,

Q280: During October, Haubold Corporation budgeted for 30,000