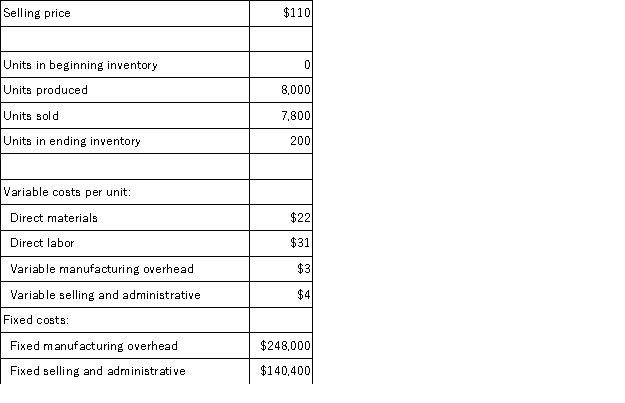

Chown Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  The total gross margin for the month under the absorption costing approach is:

The total gross margin for the month under the absorption costing approach is:

Definitions:

Corporate Tax Rate

The tax that corporations are required to pay on their income, which varies by country and sometimes by the level of income or industry.

Embedded Debt Cost

The total expenses, both direct and indirect, associated with issuing and carrying debt over its entire life, including interest payments and fees.

Actual Cost

The true total amount spent on a project or acquisition, including all relevant expenses and fees.

Market Rate

The prevailing interest rate available in the marketplace for loans, savings, and investments, also reflecting the cost of borrowing money.

Q17: Only variable manufacturing overhead costs are included

Q21: Muecke Inc. is working on its cash

Q51: Brees Inc., a company that produces and

Q65: The following are budgeted data for the

Q74: The "costs accounted for" portion of the

Q116: Seiersen Corporation's contribution format income statement for

Q124: Parsons Corporation plans to sell 18,000 units

Q145: Carter Lumber sells lumber and general building

Q179: In activity-based costing, unit product costs computed

Q182: Seekell Memorial Diner is a charity supported