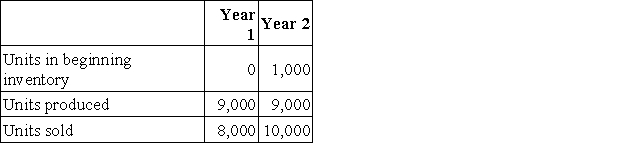

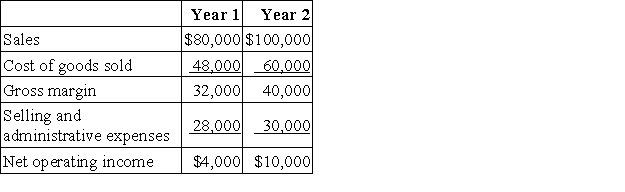

Hanks Corporation produces a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead was $18,000 in each year. This fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.

Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead was $18,000 in each year. This fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.

Required:

a. Compute the unit product cost in each year under variable costing.

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Audience

The group of people a message or piece of communication is intended for.

Résumé Format

The structure and organization of a résumé, which can vary in style, such as chronological, functional, or combination formats.

Résumé Length

The optimal or appropriate number of pages for a resume, typically influenced by the individual’s experience level and the job's requirements.

Job Title

A designation given to an employment position that describes the nature of the job and sometimes the level of responsibility.

Q11: Caprice Corporation is a wholesaler of industrial

Q19: If a cost is a common cost

Q71: The margin of safety is:<br>A)the excess of

Q75: Barker Corporation uses the weighted-average method in

Q83: Solen Corporation's break-even-point in sales is $900,000,

Q173: Meyer Corporation has two sales areas: North

Q176: Aaker Corporation, which has only one product,

Q226: Aaker Corporation, which has only one product,

Q264: Kestner Clinic uses patient-visits as its measure

Q401: Sinopoli Corporation bases its budgets on machine-hours.