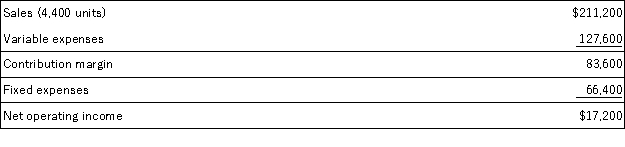

Lepage Corporation has provided its contribution format income statement for January. The company produces and sells a single product.  If the company sells 4,700 units, its total contribution margin should be closest to:

If the company sells 4,700 units, its total contribution margin should be closest to:

Definitions:

Capital Cost Allowance

A tax deduction available in some jurisdictions for tangible and intangible assets, allowing businesses to write off the cost of assets over their useful life.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in a linear fashion, resulting in a constant annual depreciation expense.

Tax Rate

The percentage at which an individual or corporation is taxed by the government, applicable to income, capital gain, or other taxable bases.

IFRS 8

An International Financial Reporting Standard that requires companies to report financial information by business segment to provide a clearer understanding of a company’s performance.

Q5: Data concerning Marchman Corporation's single product appear

Q15: Clemmens Corporation has two major business segments:

Q20: The contribution margin ratio of Baginski Corporation's

Q35: Bohlen Corporation produces and sells a single

Q37: Which of the following might be included

Q47: The following are budgeted data for the

Q85: Common fixed costs should not be charged

Q123: Ragins Corporation produces a single product and

Q131: Upchurch Corporation produces and sells a single

Q134: The cost of a completed job in