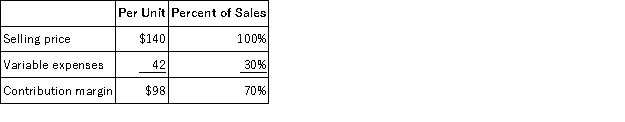

Hartung Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Fixed Asset Account

An account on the balance sheet that reports the cost and accumulated depreciation of long-term tangible assets used in the operations of a business.

Accumulated Depreciation

The cumulative depreciation of an asset up to a single point in its life, reflecting its decrease in value over time.

Debit

A bookkeeping entry that boosts an asset or expense account, or reduces a liability or equity account.

Tangible Asset

Physical assets or property owned by a person or company, such as buildings, machinery, and vehicles.

Q16: Crossbow Corp. produces a single product. Data

Q36: Molette, Inc., manufactures and sells two products:

Q64: If a company decreases the variable expense

Q82: Cashan Corporation makes and sells a product

Q123: Drucker, Inc., manufactures and sells two products:

Q165: Masiclat, Inc., manufactures and sells two products:

Q171: Data concerning Marchman Corporation's single product appear

Q185: During its first year of operations, Carlos

Q185: Smee Inc. produces and sells a single

Q186: Crossbow Corp. produces a single product. Data