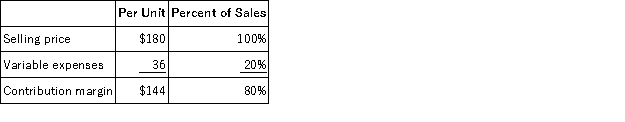

Salley Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $1,133,000 per month. The company is currently selling 9,000 units per month. Management is considering using a new component that would increase the unit variable cost by $7. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $1,133,000 per month. The company is currently selling 9,000 units per month. Management is considering using a new component that would increase the unit variable cost by $7. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Q6: Jeanlouis, Inc., manufactures and sells two products:

Q31: Cashan Corporation makes and sells a product

Q42: Boutet, Inc., manufactures and sells two products:

Q81: Schweinert Corporation manufactures a single product. The

Q93: Molinas, Inc., manufactures and sells two products:

Q99: The number of units to be produced

Q122: Aaker Corporation, which has only one product,

Q126: Zimmerli Corporation manufactures a single product. The

Q148: Buccheri Corporation produces and sells a single

Q225: Pevy Corporation has two divisions: Southern Division