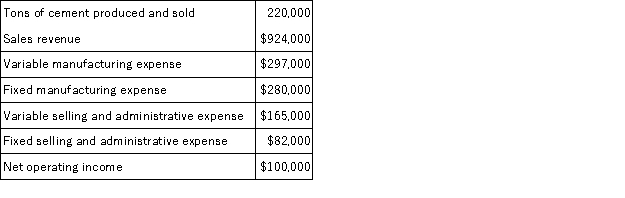

A cement manufacturer has supplied the following data:  The company's contribution margin ratio is closest to:

The company's contribution margin ratio is closest to:

Definitions:

FIFO

A cost flow assumption for inventory and financial accounting where the first goods purchased or produced are the first to be sold.

FIFO Inventory

An inventory costing method that assumes the items purchased or produced first are sold first, thereby remaining inventory consists of items added most recently.

Cash Transactions

Financial transactions involving the immediate payment of cash for the purchase of goods or services.

Q2: Common fixed expenses should be allocated to

Q5: Higgins Corporation sells three products, Product A,

Q19: Edgington Inc. bases its manufacturing overhead budget

Q55: Romasanta Corporation manufactures a single product. The

Q88: Randolph, Inc., manufactures and sells two products:

Q105: JT Department Store expects to generate the

Q144: A tile manufacturer has supplied the following

Q166: Mahaxay Corporation has provided its contribution format

Q195: Villeda Corporation uses the following activity rates

Q214: Sidell Inc., which produces a single product,