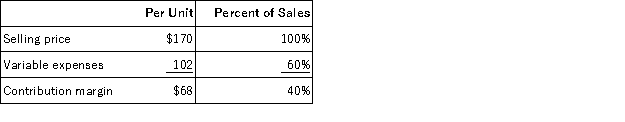

Boenisch Corporation produces and sells a single product with the following characteristics:  The company is currently selling 8,000 units per month. Fixed expenses are $406,000 per month. Consider each of the following questions independently. This question is to be considered independently of all other questions relating to Boenisch Corporation. Refer to the original data when answering this question.

The company is currently selling 8,000 units per month. Fixed expenses are $406,000 per month. Consider each of the following questions independently. This question is to be considered independently of all other questions relating to Boenisch Corporation. Refer to the original data when answering this question.

The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $16 per unit. In exchange, the sales staff would accept a decrease in their salaries of $102,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 700 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Direct Labor

The wages paid to workers who are directly involved in the production of goods or in providing services.

Direct Materials

Raw materials that can be directly attributed to the production of specific goods or services in the manufacturing process.

Factory Utilities

The cost of services such as electricity, water, and gas used in the manufacturing process.

Managerial Accounting

Managerial accounting involves the provision of financial data and advice to a company's management for decision-making.

Q45: Sosinski Corporation has two divisions: Domestic Division

Q47: At the break-even point, the total contribution

Q63: Mcleese, Inc., manufactures and sells two products:

Q72: When the weighted-average method of process costing

Q75: Jameson Corporation uses a predetermined overhead rate

Q92: Betenbaugh, Inc., manufactures and sells two products:

Q112: A tile manufacturer has supplied the following

Q116: Last year, Rassel Corporation's variable costing net

Q171: Data concerning Marchman Corporation's single product appear

Q175: When using segmented income statements, the dollar