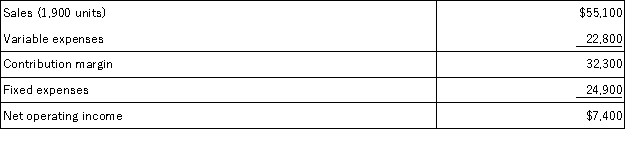

Buentello Corporation produces and sells a single product. The company's contribution format income statement for January appears below:  Required:

Required:

Redo the company's contribution format income statement assuming that the company sells 1,600 units.

Definitions:

Machine-Hours

A measure of the amount of time machines are running in the production process, used as a basis for allocating overhead costs.

Manufacturing Overhead

All indirect costs related to the production process, such as maintenance, utilities, and quality control, not directly traceable to a product.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products, calculated before the production process begins based on estimated costs and activity levels.

Job-Order Costing

An accounting method used to assign costs to specific products or jobs, typically utilized in custom or specialized production.

Q2: In the past, Hypochondriac Hospital allocated all

Q22: Gaskey Inc. expects its sales in February

Q26: Cervetti Corporation has two major business segments-East

Q31: The controller of Hartis Company estimates the

Q44: Data concerning Sumter Corporation's single product appear

Q84: Under variable costing, fixed manufacturing overhead cost

Q125: Muecke Inc. is working on its cash

Q146: A manufacturing company that produces a single

Q147: Noel Enterprises has budgeted sales in units

Q162: Romasanta Corporation manufactures a single product. The