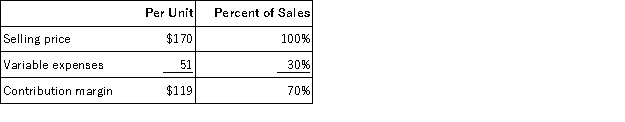

Data concerning Ulwelling Corporation's single product appear below:  Fixed expenses are $753,000 per month. The company is currently selling 8,000 units per month.

Fixed expenses are $753,000 per month. The company is currently selling 8,000 units per month.

Required:

The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $73,000 per month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by 300 units. What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Definitions:

Straight-Line Depreciation

A method of allocating the cost of an asset evenly across its useful life.

Capital Budgeting

The procedure of appraising and opting for long-term investments consistent with the goal of increasing the wealth of shareholders.

Straight-Line Depreciation

This refers to a method where the cost of a fixed asset is evenly reduced over its useful life.

Capital Budgeting

The process of making investment decisions in long-term assets and projects, evaluating their potential costs and benefits to ensure the most financially beneficial investments are made.

Q26: The records of the Dodge Corporation show

Q41: The following information relates to the Assembly

Q59: Torbert, Inc., produces and sells a single

Q83: Acton Corporation, which applies manufacturing overhead on

Q121: Kosco Corporation produces a single product. The

Q126: Zimmerli Corporation manufactures a single product. The

Q152: A company that makes organic fertilizer has

Q170: Cleckley Corporation's operating leverage is 5.9. If

Q206: Mcleese, Inc., manufactures and sells two products:

Q210: A common fixed cost is a fixed