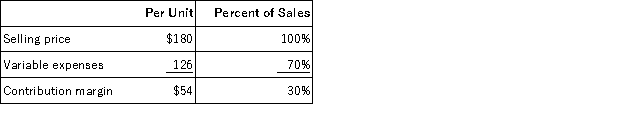

Data concerning Kurek Corporation's single product appear below:  Fixed expenses are $190,000 per month. The company is currently selling 4,000 units per month.

Fixed expenses are $190,000 per month. The company is currently selling 4,000 units per month.

Required:

The marketing manager would like to cut the selling price by $12 and increase the advertising budget by $11,100 per month. The marketing manager predicts that these two changes would increase monthly sales by 1,500 units. What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Definitions:

Q2: Common fixed expenses should be allocated to

Q8: Liest Corporation produces and sells a single

Q9: Olide, Inc., manufactures and sells two products:

Q72: When the weighted-average method of process costing

Q73: Blane Corporation produces and sells a single

Q84: Activities consume resources. In activity-based costing an

Q103: Gupta Inc. uses the weighted-average method in

Q107: Arizaga Corporation manufactures canoes in two departments,

Q180: Meyer Corporation has two sales areas: North

Q213: Crystal Corporation produces a single product. The