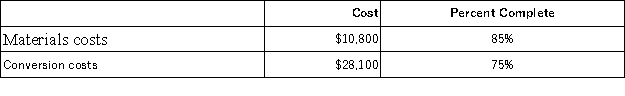

Evans Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 900 units. The costs and percentage completion of these units in beginning inventory were:  A total of 8,100 units were started and 6,800 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

A total of 8,100 units were started and 6,800 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:  The ending inventory was 60% complete with respect to materials and 10% complete with respect to conversion costs. Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

The ending inventory was 60% complete with respect to materials and 10% complete with respect to conversion costs. Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

The cost per equivalent unit for materials for the month in the first processing department is closest to:

Definitions:

Fixed Costs

Costs that do not vary with the level of output production, such as rent, salaries, and insurance.

Quasi-Fixed Costs

Costs that are not strictly variable or fixed but have elements of both, changing with adjustments in the level of business activity or scale of operations over time.

Marginal Costs

The additional cost required to produce one more unit of a product, reflecting how total costs change with production volume.

Total Cost Function

An equation that expresses the total cost of producing a given quantity of output as the sum of all production costs.

Q6: A fixed cost remains constant if expressed

Q8: Which of the following entries would correctly

Q21: Punches, Inc., manufactures and sells two products:

Q35: Errera Corporation has two major business segments-Retail

Q69: Hewett, Inc., manufactures and sells two products:

Q100: Eddy Corporation has provided the following production

Q109: Routit Corporation had the following sales and

Q139: The following data were provided by Rider,

Q183: Pachero, Inc., manufactures and sells two products:

Q203: Kosco Corporation produces a single product. The