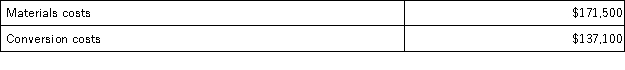

Carmon Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 700 units. The costs and percentage completion of these units in beginning inventory were:  A total of 7,900 units were started and 6,900 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

A total of 7,900 units were started and 6,900 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:  The ending inventory was 70% complete with respect to materials and 35% complete with respect to conversion costs. Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

The ending inventory was 70% complete with respect to materials and 35% complete with respect to conversion costs. Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

What are the equivalent units for conversion costs for the month in the first processing department?

Definitions:

Time Pressures

The stress and challenges arising from having limited time to complete tasks or make decisions.

Mintzberg

Henry Mintzberg is a renowned management thinker, known for his work on organizational structures, strategy, and management roles.

After-Event Review

A debriefing process conducted following an event or project, aimed at identifying what was successful, what failed, and how future endeavors can be improved.

Experiential Learning Program

A learning approach based on the principle that individuals learn more effectively through direct experience and reflection on that experience.

Q9: Olide, Inc., manufactures and sells two products:

Q33: Collins Corporation uses a predetermined overhead rate

Q35: Bohlen Corporation produces and sells a single

Q91: Morganti Corporation sells a product for $140

Q102: Inventoriable costs are also known as:<br>A)variable costs.<br>B)conversion

Q149: Gould Corporation uses the following activity rates

Q156: Sill, Inc., manufactures and sells two products:

Q156: Walkenhorst Corporation has two divisions: Bulb Division

Q175: Mellencamp, Inc., manufactures and sells two products:

Q194: Finken, Inc., manufactures and sells two products: