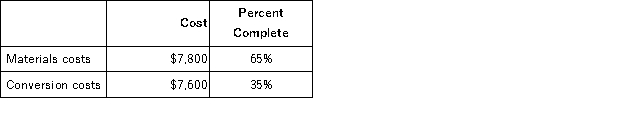

Fulton Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 800 units. The costs and percentage completion of these units in beginning inventory were:  A total of 9,900 units were started and 8,900 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

A total of 9,900 units were started and 8,900 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:  The ending inventory was 70% complete with respect to materials and 60% complete with respect to conversion costs. Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

The ending inventory was 70% complete with respect to materials and 60% complete with respect to conversion costs. Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

The total cost transferred from the first processing department to the next processing department during the month is closest to:

Definitions:

Amendment

A formal change or addition made to a document, law, or constitution.

Reasonable Expenses

Costs that are deemed necessary and appropriate under given circumstances, often in a legal or business context.

Junior Lienholders

Creditors who have claims on a property that are ranked below other debts in terms of repayment priority in case of default.

Collateral

A form of security provided by the borrower to the lender, consisting of property or assets, that can be taken possession of should the borrower fail to repay the loan.

Q5: Data concerning Marchman Corporation's single product appear

Q29: O'Neill, Incorporated's segmented income statement for the

Q30: In calculating cost per equivalent unit under

Q33: Collins Corporation uses a predetermined overhead rate

Q39: Which of the following statements about a

Q41: The following information relates to the Assembly

Q52: All of the following would be classified

Q83: Acton Corporation, which applies manufacturing overhead on

Q107: Caber Corporation applies manufacturing overhead on the

Q176: Aaker Corporation, which has only one product,