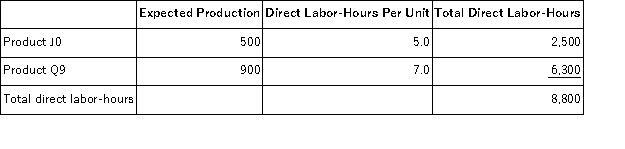

Wlodarczyk, Inc., manufactures and sells two products: Product J0 and Product Q9. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

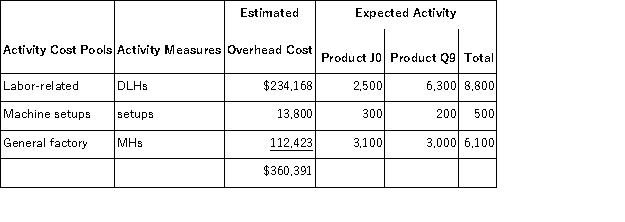

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product J0 under activity-based costing is closest to:

The overhead applied to each unit of Product J0 under activity-based costing is closest to:

Definitions:

Straight-line Depreciation

A method for dispersing the cost of a physical asset across its useful life in even annual allocations.

Discounted Payback

A capital budgeting method used to determine the profitability of an investment by calculating the time it takes for the present value of cash flows to cover the initial investment cost.

Annual Cash Flows

The total amount of money being transferred in and out of a business, considered on a yearly basis.

Required Rate

The minimum return an investor expects to achieve on an investment, considering its risk, also known as the hurdle rate or the required rate of return.

Q15: Boutet, Inc., manufactures and sells two products:

Q20: Bolerjack, Inc., manufactures and sells two products:

Q29: Direct labor is a part of prime

Q40: During February, Irving Corporation incurred $65,000 of

Q49: Comco, Inc. has accumulated the following data

Q51: Conversion cost is the sum of direct

Q65: Commissions paid to salespersons are a variable

Q65: If sales volume decreases, and all other

Q165: Moccio Enterprises, Inc., produces and sells a

Q168: When the activity level declines within the