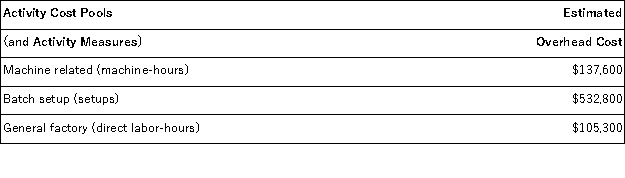

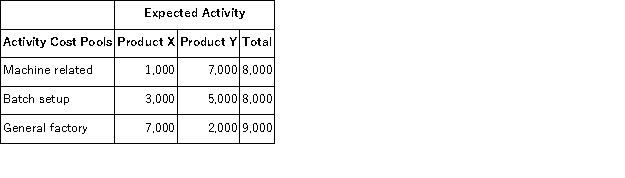

Angara Corporation uses activity-based costing to determine product costs for external financial reports. The company has provided the following data concerning its activity-based costing system:

The activity rate for the batch setup activity cost pool is closest to:

The activity rate for the batch setup activity cost pool is closest to:

Definitions:

Straight-Line Depreciation

A way of allocating an asset's expenditure smoothly over its effective life.

After-Tax Discount Rate

The interest rate used in discounting cash flows that takes into account the tax implications of the investment.

Incremental Sales

The additional revenue generated from a specific business decision or action.

Cash Operating Expenses

Expenses incurred during the normal operation of a business that affect its cash position, such as rent, utilities, and payroll, excluding non-cash expenses like depreciation.

Q30: Paparo Corporation has provided the following data

Q33: Collins Corporation uses a predetermined overhead rate

Q42: Boutet, Inc., manufactures and sells two products:

Q78: If the actual manufacturing overhead cost for

Q94: Yoder Corporation uses the weighted-average method in

Q114: Which of the following is classified as

Q129: The unit sales volume necessary to reach

Q139: Dillon Corporation applies manufacturing overhead to jobs

Q146: In the most recent month, Shoemaker Corporation's

Q162: A partial listing of costs incurred at