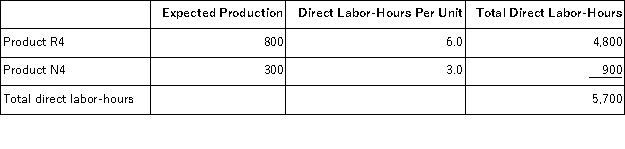

Serva, Inc., manufactures and sells two products: Product R4 and Product N4. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.70 per DLH. The direct materials cost per unit for each product is given below:

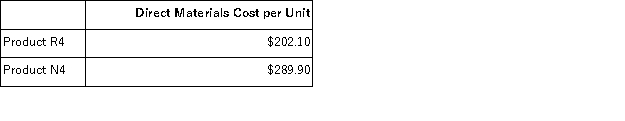

The direct labor rate is $24.70 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

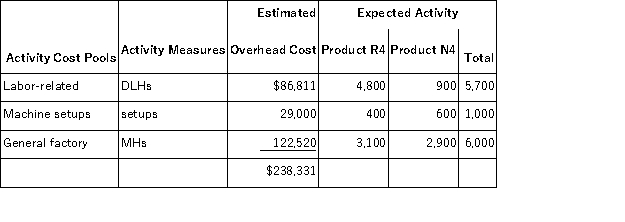

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

Definitions:

BCG Matrix

A strategic analysis tool that helps organizations prioritize their business units or products by categorizing them into four types based on market growth and market share: Stars, Cash Cows, Question Marks, and Dogs.

Cash Flow

Cash flow refers to the net amount of cash and cash-equivalents being transferred into and out of a business.

Question Marks

Products or businesses that operate in high-growth markets but have low market share, often requiring significant investment to improve their position.

Q8: Contribution margin equals revenue minus all fixed

Q38: Facility-level activities are activities that are carried

Q50: Fabian Corporation uses the weighted-average method in

Q50: Din, Inc., manufactures and sells two products:

Q54: Arthur Corporation has a margin of safety

Q73: At a sales volume of 35,000 units,

Q94: Cardillo Inc., an escrow agent, has provided

Q106: Manufacturing salaries and wages incurred in the

Q120: Sammis Inc., which produces and sells a

Q161: A contribution format income statement for a