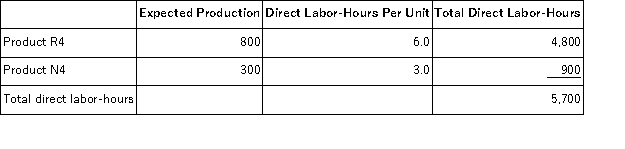

Serva, Inc., manufactures and sells two products: Product R4 and Product N4. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.70 per DLH. The direct materials cost per unit for each product is given below:

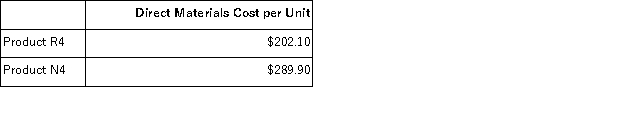

The direct labor rate is $24.70 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

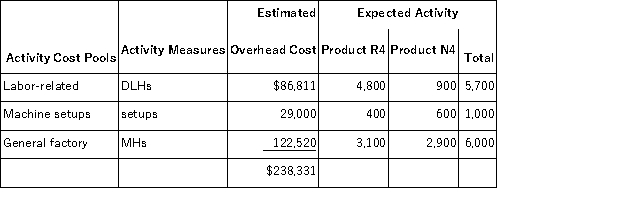

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product N4 under activity-based costing is closest to:

The overhead applied to each unit of Product N4 under activity-based costing is closest to:

Definitions:

Net Taxes

The difference between total taxes paid and government transfers received, representing the actual tax burden on an individual or business.

Shifted

Refers to a change in position or direction, often used in economics to describe movements in supply or demand curves.

Sales Tax

A tax imposed on sales of goods and services, typically calculated as a percentage of the purchase price and collected by the retailer.

Q2: You have deposited $15,584 in a special

Q5: Diemer, Inc., manufactures and sells two products:

Q11: The present value of an amount to

Q14: Kamp Company uses the weighted-average method in

Q36: Costs are accumulated by department in a

Q76: Jawson Corporation uses the weighted-average method in

Q136: Hammer, Inc., manufactures and sells two products:

Q169: Hirz Corporation produces and sells a single

Q174: The contribution margin ratio is equal to:<br>A)Total

Q196: Breedon Corporation produces a single product. Data