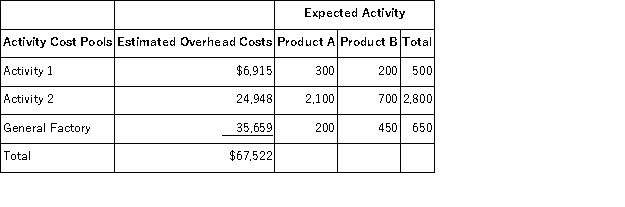

Adams Company has two products: A andB. The annual production and sales of Product A is 500 units and of Product B is 900 units. The company has traditionally used direct labor-hours (DLHs) as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.5 direct labor-hours per unit. The total estimated overhead for next period is $67,522. The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools-Activity 1, Activity 2, and General Factory-with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The predetermined overhead rate (i.e., activity rate) for Activity 1 under the activity-based costing system is closest to:

Definitions:

Statistical Analysis

The process of collecting, reviewing, and interpreting data to discover patterns and significance in the collected information.

Positive Reinforcement

A concept in behavioral psychology where the introduction of a desirable or pleasant stimulus after a behavior increases the likelihood of that behavior occurring in the future.

Negative Reinforcement

A behavior modification technique where the removal of an undesirable or unpleasant stimulus strengthens a desired behavior.

Operant Conditioning

A learning process in behavioral psychology where the strength of a behavior is modified by reinforcement or punishment.

Q16: Abbott Company's manufacturing overhead is 20% of

Q30: Data for March concerning Mauger Corporation's two

Q33: If the actual purchase price for materials

Q50: Fabian Corporation uses the weighted-average method in

Q96: Ibarra Corporation uses the weighted-average method in

Q101: Hadrana Corporation reports that at an activity

Q142: Pirkl Corporation has provided the following data

Q165: Masiclat, Inc., manufactures and sells two products:

Q174: Angara Corporation uses activity-based costing to determine

Q184: Trezise, Inc., manufactures and sells two products: