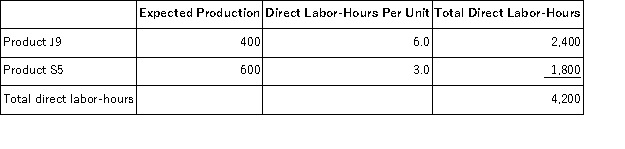

Accurso, Inc., manufactures and sells two products: Product J9 and Product S5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:

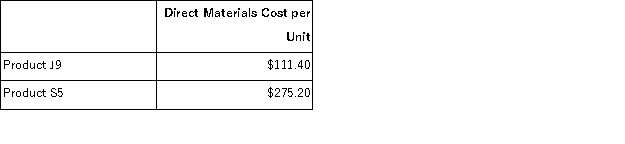

The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

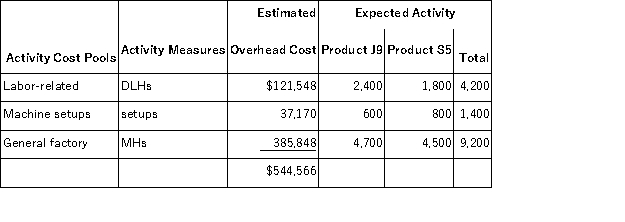

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product J9 under activity-based costing is closest to:

The overhead applied to each unit of Product J9 under activity-based costing is closest to:

Definitions:

Fair Value

An estimate of the price at which an asset or liability could be bought or sold in a current transaction between willing parties.

Net Assets

The total assets of a company minus its total liabilities, reflecting the company's financial position at a specific point in time.

Acquisition

Taking over another corporation by buying out its equity or assets.

Fair Value

The approximate value for which an asset or liability might be exchanged in an equitable deal between consenting parties, excluding scenarios of compelled or liquidation sales.

Q7: Cerrone Inc. has provided the following data

Q20: The contribution margin ratio of Baginski Corporation's

Q35: Bohlen Corporation produces and sells a single

Q42: Boutet, Inc., manufactures and sells two products:

Q88: Randolph, Inc., manufactures and sells two products:

Q93: Barker Corporation uses the weighted-average method in

Q125: Hane Corporation uses the following activity rates

Q131: The following partially completed T-accounts summarize transactions

Q172: Davis Corporation has provided the following production

Q198: Roskos Corporation has two divisions: Town Division