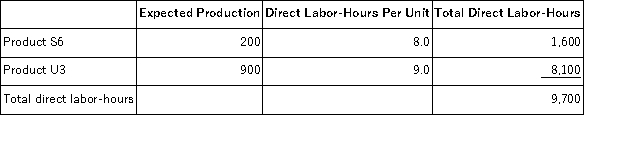

Sampaga, Inc., manufactures and sells two products: Product S6 and Product U3. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $20.90 per DLH. The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

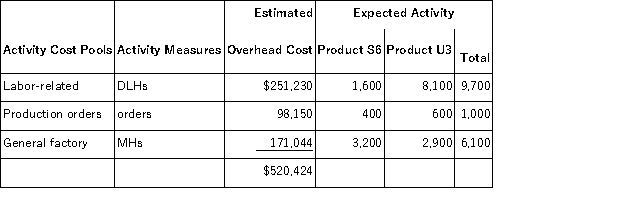

The direct labor rate is $20.90 per DLH. The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product U3 under activity-based costing is closest to:

The overhead applied to each unit of Product U3 under activity-based costing is closest to:

Definitions:

Homozygous Varieties

Organisms that possess two identical alleles for a specific gene or trait.

Dominant

Refers to an allele that masks the effect of a recessive allele paired with it in heterozygous individuals.

Dwarf

Refers to an organism, object, or being that is significantly smaller than the typical size for its species or type.

Homozygous Varieties

Organisms that have two identical alleles for a specific trait, resulting in a uniform expression of that trait.

Q45: Carmon Corporation uses the weighted-average method in

Q47: The following information relates to the Assembly

Q49: An unfavorable materials price variance is recorded

Q68: Process costing is used in those situations

Q72: Bohlen Corporation produces and sells a single

Q97: A job-order cost system would be used

Q97: Bee Company is a honey wholesaler. An

Q107: Caber Corporation applies manufacturing overhead on the

Q158: Comparative income statements for Tudor Retailing Company

Q184: Anderson Corporation has provided the following