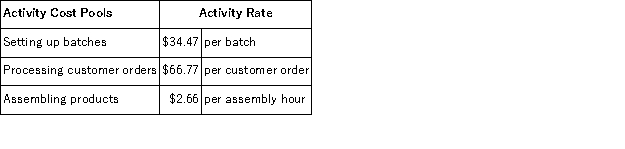

Villeda Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.  Data concerning two products appear below:

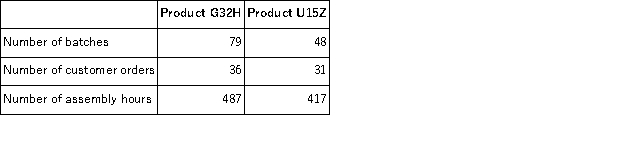

Data concerning two products appear below:  Required:

Required:

How much overhead cost would be assigned to each of the two products using the company's activity-based costing system?

Definitions:

Idle Capacity

Unused production capability in a given period, often resulting in inefficiency and increased costs.

Supervisory Wages

Costs associated with the salaries of supervisory personnel, considered part of manufacturing overhead in production environments.

Activity-based Costing

Activity-based costing is an accounting method that assigns costs to products based on the activities they require.

Overhead Cost

General expenses related to the day-to-day operations of a business that cannot be directly linked to a specific product or service.

Q3: Last year, Knox Corporation reported on its

Q22: The following journal entry would be made

Q32: Maggie Manufacturing Company applies manufacturing overhead to

Q55: Comco, Inc. has accumulated the following data

Q56: Data concerning Kuralt Corporation's single product appear

Q88: Bee Company is a honey wholesaler. An

Q91: Electrical costs at one of Kantola Corporation's

Q93: Gauani Corporation produces and sells a single

Q111: Filosa, Inc., manufactures and sells two products:

Q131: The following partially completed T-accounts summarize transactions