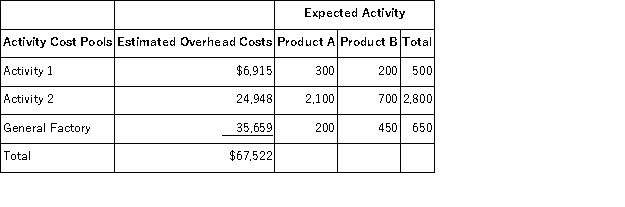

Adams Company has two products: A andB. The annual production and sales of Product A is 500 units and of Product B is 900 units. The company has traditionally used direct labor-hours (DLHs) as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.5 direct labor-hours per unit. The total estimated overhead for next period is $67,522. The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools-Activity 1, Activity 2, and General Factory-with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The predetermined overhead rate (i.e., activity rate) for Activity 1 under the activity-based costing system is closest to:

Definitions:

Gift Tax

A federal tax on the transfer of property by gift during the donor's lifetime, intended to prevent tax avoidance through the transfer of wealth.

Long-term Loss

A financial loss realized on the sale or exchange of an asset held for more than one year, affecting capital gains tax calculations.

Adjusted Basis

The original cost of property plus any improvements, or minus depreciation or losses, used to calculate capital gains or losses for tax purposes.

FMV

Fair Market Value, the price at which property would sell between a willing buyer and seller in an arm's length transaction.

Q7: The changes in Northrup Corporation's balance sheet

Q9: Peals Corporation has two divisions: Home Division

Q17: Digby Corporation's balance sheet and income statement

Q26: The most recent balance sheet and income

Q27: Which of the following companies would have

Q58: In activity-based costing, the activity rate for

Q78: If the actual manufacturing overhead cost for

Q91: Morganti Corporation sells a product for $140

Q102: Inventoriable costs are also known as:<br>A)variable costs.<br>B)conversion

Q158: Florek Inc. produces and sells a single