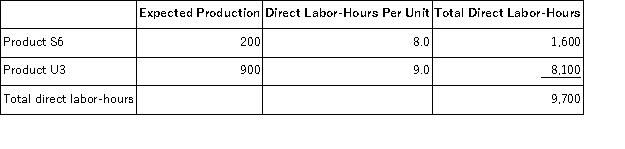

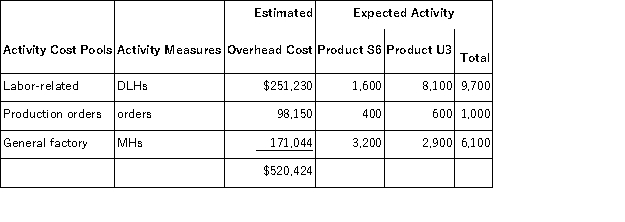

Sampaga, Inc., manufactures and sells two products: Product S6 and Product U3. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $20.90 per DLH. The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $20.90 per DLH. The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product U3 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product U3 would be closest to:

Definitions:

Utility

the total satisfaction or benefit derived from consuming a good or service.

Individual's Intelligence

A measure of a person's cognitive capabilities, including the ability to learn, understand, and apply knowledge.

Executive Control Processes

The cognitive processes that regulate an individual's ability to organize thoughts, actions, and emotions to achieve goals.

Validity

The extent to which a concept, conclusion, or measurement is well-founded and likely corresponds accurately to the real world.

Q29: At the beginning of December, Sneeden Corporation

Q62: When the level of activity decreases, variable

Q87: Evans Corporation uses the weighted-average method in

Q89: Besser, Inc., manufactures and sells two products:

Q97: Serva, Inc., manufactures and sells two products:

Q116: During December, Deller Corporation purchased $79,000 of

Q117: Abbe, Inc., manufactures and sells two products:

Q132: Caber Corporation applies manufacturing overhead on the

Q160: Management of Childers Corporation is considering whether

Q168: When the activity level declines within the