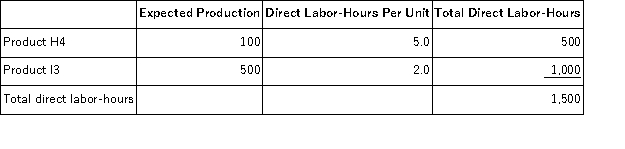

Jaure, Inc., manufactures and sells two products: Product H4 and Product I3. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $29.40 per DLH. The direct materials cost per unit is $244.70 for Product H4 and $206.20 for Product I3.

The direct labor rate is $29.40 per DLH. The direct materials cost per unit is $244.70 for Product H4 and $206.20 for Product I3.

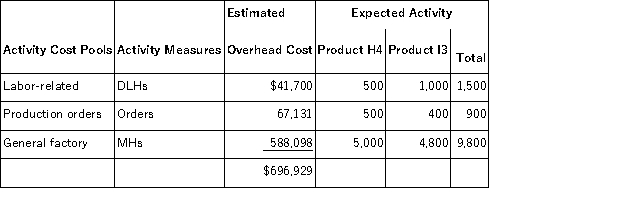

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

a. Compute the activity rates under the activity-based costing system.

b. Determine how much overhead would be assigned to each product under the activity-based costing system.

c. Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Agency Staff

Employees or workers who are part of an organization or agency, contributing to its goals and objectives.

Policy

A course or principle of action adopted or proposed by an organization or individual, often in the form of rules, laws, or guidelines.

Multiple Locations

Multiple locations refer to the presence or operation of entities, activities, or processes in more than one geographical area, highlighting the scope or distribution of certain actions.

Prestige

The respect and admiration that an individual or organization gains based on achievements or quality.

Q3: Cafferty Corporation has provided the following data

Q14: Callicott Corporation produces a product that sells

Q19: Which of the following would be classified

Q25: Using process costing, it is necessary to

Q35: Carr Corporation's comparative balance sheet and income

Q40: Accurso, Inc., manufactures and sells two products:

Q62: The July contribution format income statement of

Q94: Yoder Corporation uses the weighted-average method in

Q100: A company that makes organic fertilizer has

Q162: A partial listing of costs incurred at