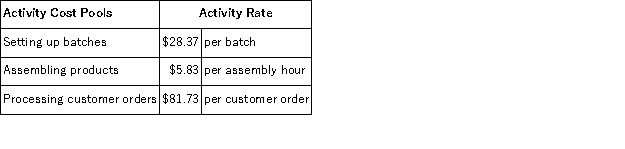

Garhart Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.  Data concerning two products appear below:

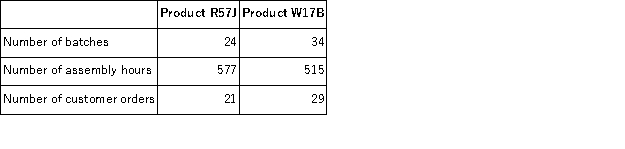

Data concerning two products appear below:  Required:

Required:

a. How much overhead cost would be assigned to Product R57J using the company's activity-based costing system? Show your work!

b. How much overhead cost would be assigned to Product W17B using the company's activity-based costing system? Show your work!

Definitions:

Common Stock

Equity ownership in a corporation, with voting rights and a share in dividends.

Corporate Bond

A debt security issued by a corporation and sold to investors to raise financing for capital-intensive projects or operational costs.

Primary Market

The financial market where new securities are issued and sold for the first time, typically directly by the issuer to investors.

Secondary Market

A financial market where previously issued financial instruments such as stock, bonds, options, and futures are bought and sold.

Q16: Abbott Company's manufacturing overhead is 20% of

Q18: On August 1, Shead Corporation had $35,000

Q24: During October, Dorinirl Corporation incurred $60,000 of

Q25: Emco Company uses direct labor cost as

Q46: Acklac Corporation uses the weighted-average method in

Q49: A fixed manufacturing overhead volume variance occurs

Q59: Paulson Corporation uses a predetermined overhead rate

Q99: Upchurch Corporation produces and sells a single

Q133: Sampaga, Inc., manufactures and sells two products:

Q159: The engineering approach to the analysis of