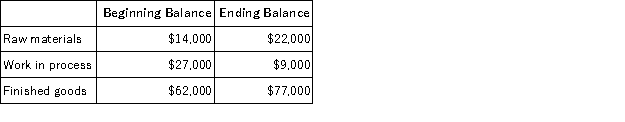

Bakerston Company is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year:  The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year:

• Raw materials were purchased, $315,000.

• Raw materials were requisitioned for use in production, $307,000 ($281,000 direct and $26,000 indirect).

• The following employee costs were incurred: direct labor, $377,000; indirect labor, $96,000; and administrative salaries, $172,000.

• Selling costs, $147,000.

• Factory utility costs, $10,000.

• Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling, general, and administrative activities.

• Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34,000 machine-hours.

• Sales for the year totaled $1,253,000.

Required:

a. Prepare a schedule of cost of goods manufactured.

b. Was the overhead underapplied or overapplied? By how much?

c. Prepare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Definitions:

Industrialized Nation

A country whose economy is characterized by the large-scale use of industry and manufacturing technology, leading to high levels of income and development.

Separate Spheres

A gender ideology that emerged in the 19th century, suggesting that men and women have distinct roles, with women belonging in the private domain of home and family, and men in the public sphere of work and politics.

Tocqueville

French political thinker and historian best known for his works "Democracy in America" illustrating his observations of the American political and social system.

Gender Relations

The social interactions and expectations that arise based on perceived differences between sexes, including the roles, rights, and responsibilities assigned to men and women.

Q3: Rariton Corporation uses the weighted-average method in

Q10: Harker Corporation uses the weighted-average method in

Q18: Florea Corporation has provided the following data

Q50: Romano Corporation allocates administrative costs on

Q74: The following cost data pertain to the

Q91: A manufacturer of playground equipment uses a

Q108: Donham Corporation had $25,000 of raw materials

Q124: Hacken Company has a job-order costing system.

Q149: Gould Corporation uses the following activity rates

Q192: Hewett, Inc., manufactures and sells two products: