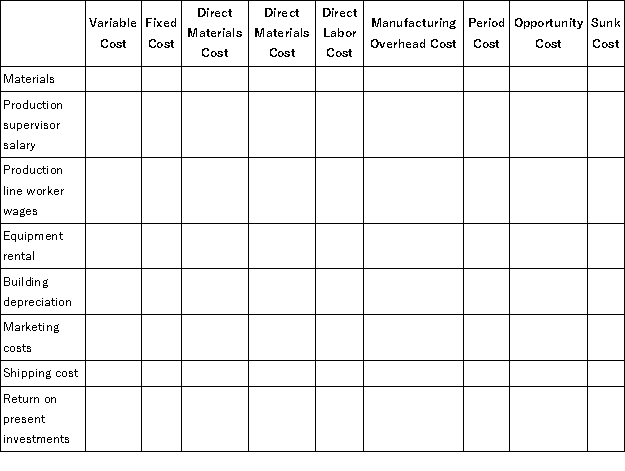

The Plastechnics Company began operations several years ago. The company's product requires materials that cost $25 per unit. The company employs a production supervisor whose salary is $2,000 per month. Production line workers are paid $15 per hour to manufacture and assemble the product. The company rents the equipment needed to produce the product at a rental cost of $1,500 per month. The building is depreciated on the straight-line basis at $9,000 per year.

The company spends $40,000 per year to market the product. Shipping costs for each unit are $20 per unit.

The company plans to liquidate several investments in order to expand production. These investments currently earn a return of $8,000 per year.

Required:

Complete the answer sheet below by placing an "X" under each heading that identifies the cost involved. The "Xs" can be placed under more than one heading for a single cost, e.g., a cost might be a sunk cost, an overhead cost, and a product cost.

Definitions:

Activity Index

The activity that causes changes in the behavior of costs.

Variable Costs

Costs that vary directly with the level of production or service output, such as materials and labor.

Budgetary Control

The process of managing a company's income and expenditure with the aim of keeping spending in line with the budget.

Actual Results

The realized outcomes or final figures of a company's financial performance or operations, often compared against budgeted or forecasted figures.

Q18: Florea Corporation has provided the following data

Q33: Ovation Corporation has two service departments

Q33: Shimko Corporation's most recent comparative balance sheet

Q39: Compute the amount of raw materials used

Q47: If a company uses a cost-plus approach

Q67: Departmental overhead rates are generally preferred to

Q72: A company has a standard cost system

Q103: Mark Industries is currently purchasing part no.

Q125: Hane Corporation uses the following activity rates

Q125: Buker Corporation bases its predetermined overhead rate