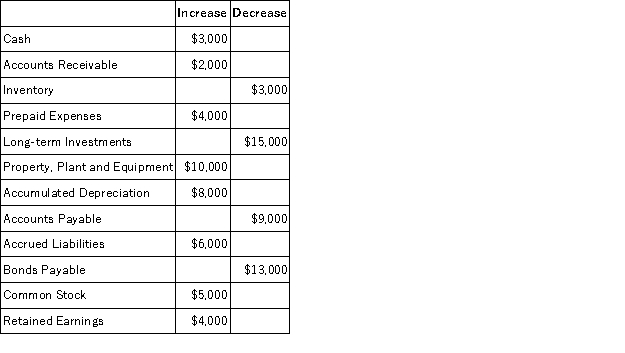

The change in each of Kendall Corporation's balance sheet accounts last year follows:  Kendall Corporation's income statement for the year was:

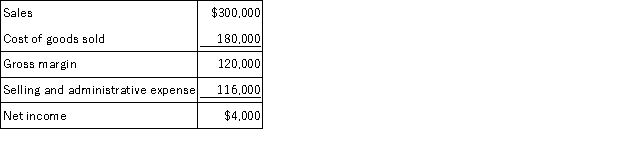

Kendall Corporation's income statement for the year was:  There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by operating activities on the statement of cash flows is determined using the direct method. Using the direct method, the cost of goods sold adjusted to a cash basis would be:

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by operating activities on the statement of cash flows is determined using the direct method. Using the direct method, the cost of goods sold adjusted to a cash basis would be:

Definitions:

Coupon Rate

The percent of the face value paid as interest on a bond every year.

Yield To Maturity

Yield to maturity is the total return anticipated on a bond if the bond is held until its maturity date, accounting for its current market price, par value, coupon interest rate, and time to maturity.

Coupon Rate

The coupon rate is the annual interest rate paid on a bond, expressed as a percentage of the face value.

Yield To Maturity

The total return anticipated on a bond if the bond is held until its maturity date, factoring in its current market price, par value, interest payments, and time to maturity.

Q10: Reven Corporation prepares its statement of cash

Q10: Porschia is considering the acquisition of new

Q12: Hreck, Inc. has two service departments

Q13: When computing standard cost variances, the difference

Q18: Which of the following would not be

Q25: A partial listing of costs incurred during

Q57: The following costs relate to Southside Company:

Q81: If all four of Argo Corporation's overhead

Q101: Parsons Corporation uses a predetermined overhead rate

Q157: The following cost data pertain to the