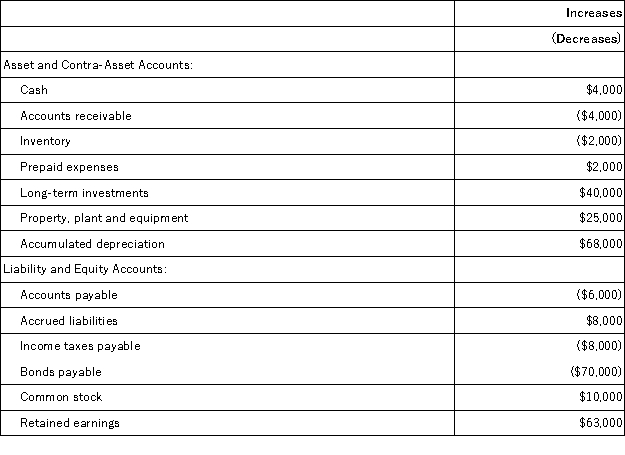

The changes in Northrup Corporation's balance sheet account balances for last year appear below:  The company's income statement for the year appears below:

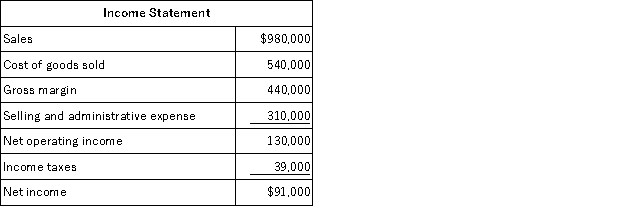

The company's income statement for the year appears below:  The company declared and paid $28,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities. On the statement of cash flows, the income tax expense adjusted to a cash basis would be:

The company declared and paid $28,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities. On the statement of cash flows, the income tax expense adjusted to a cash basis would be:

Definitions:

Economic Profits

The difference between the total revenue earned by a firm and the total costs of production, including opportunity costs.

Market Demand Curve

A graphical representation showing the total demand of all consumers in a market for a particular product at different prices.

Colluded

A situation where firms in a market agree to set prices or output levels to maximize collective profits, often at the expense of competition.

Marginal Cost

The financial implication of creating an extra unit of a product or service.

Q2: Both net present value (NPV) and the

Q22: Last year Anderson Corporation reported a cost

Q26: The most recent balance sheet and income

Q31: Corcetti Company manufactures and sells prewashed denim

Q48: At a sales volume of 30,000 units,

Q56: Gainer Corporation's standard wage rate is $11.70

Q65: Commissions paid to salespersons are a variable

Q99: On August 1, Shead Corporation had $35,000

Q99: Bee Company is a honey wholesaler. An

Q116: Masiclat, Inc., manufactures and sells two products: