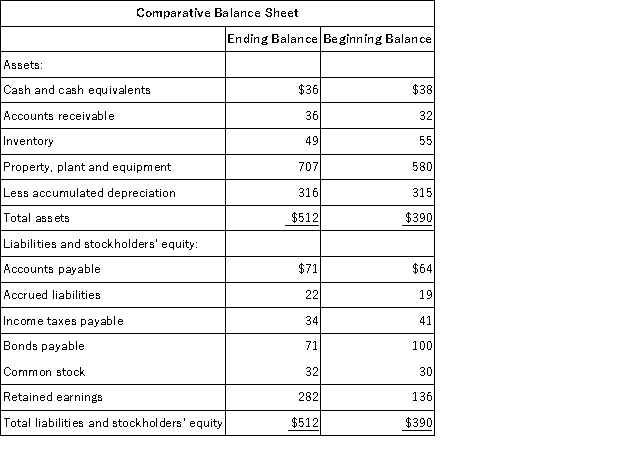

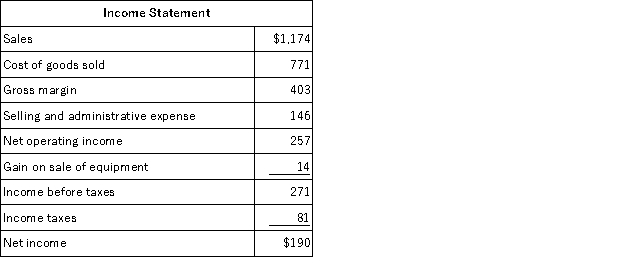

Kilduff Corporation's balance sheet and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5. The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in) investing activities for the year was:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5. The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in) investing activities for the year was:

Definitions:

Cricoid Cartilage

The ring-shaped cartilage of the larynx, located below the thyroid cartilage, serving as a point of attachment for muscles, ligaments, and membranes involved in opening and closing the airway and in speech production.

Epiglottis

A piece of cartilage at the tongue's base that moves down when swallowing to block the windpipe's entrance.

Arytenoid Cartilage

Paired cartilages located in the larynx that are crucial for the movement and tension of the vocal cords.

Lobes

Distinct regions into which certain organs or tissues, such as the brain, lungs, and liver, are divided, often with specific functions.

Q21: Messana Corporation reported the following data for

Q36: The Forbes Corporation uses a standard cost

Q49: A fixed manufacturing overhead volume variance occurs

Q64: Gandolf Corporation allocates administrative costs on

Q102: The net-present-value method assumes that project funds

Q103: Chelm Music Corporation manufactures violins, violas, cellos,

Q105: On the Schedule of Cost of Goods

Q106: Manufacturing salaries and wages incurred in the

Q106: On August 1, Shead Corporation had $35,000

Q166: Bohringer, Inc., manufactures and sells two products: