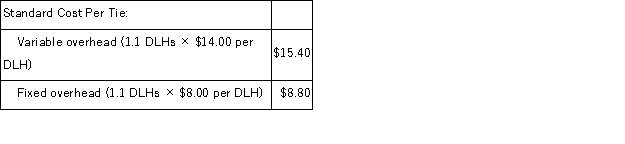

Vette Tie Corporation has developed the following manufacturing overhead standards to use in applying overhead to the production of its hand-painted silk ties. Manufacturing overhead at Vette is applied to production on the basis of standard direct labor-hours (DLHs) .  The above standards were based on an expected annual volume of 60,000 ties. The actual results for last year were as follows:

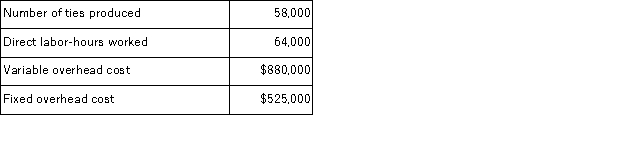

The above standards were based on an expected annual volume of 60,000 ties. The actual results for last year were as follows:  What was Vette's variable overhead rate variance?

What was Vette's variable overhead rate variance?

Definitions:

Unearned Fees

Income received by a business for which the services have not yet been performed or delivered.

Adjusted Trial Balance

A listing of all company accounts that will appear in the financial statements after adjusting entries have been made.

Supplies Expense

Costs incurred for supplies used in the operations of a business.

Adjustment Data

Information used to make changes to accounts for the purposes of accurate financial reporting, such as accruals or deferrals.

Q45: The Dillon Corporation makes and sells a

Q48: The direct labor standards at Hebden Corporation

Q54: Baker Corporation applies manufacturing overhead on the

Q63: The curve that shows the change in

Q67: The ROI calculation will indicate:<br>A) the percentage

Q88: A manufacturing company uses a standard costing

Q95: Odonell Corporation estimates that its variable manufacturing

Q103: Mark Industries is currently purchasing part no.

Q109: Country Charm Restaurant is open 24 hours

Q178: Nieman Inc., a local retailer, has provided