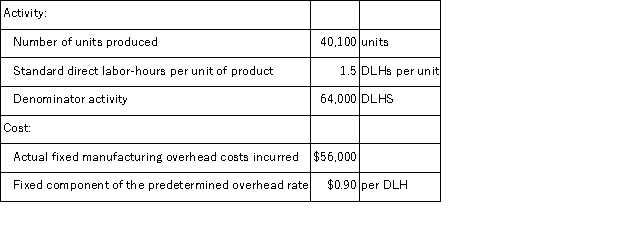

The Murray Corporation uses a standard cost system in which it applies manufacturing overhead on the basis of standard direct labor-hours (DLHs) . The company recorded the following activity and cost data for May:  The fixed manufacturing overhead budget variance for May was:

The fixed manufacturing overhead budget variance for May was:

Definitions:

Depreciable Rate

The rate at which an asset loses its value over time for accounting and tax purposes, determining its annual depreciation.

MACRS Rates

MACRS Rates refer to the depreciation rates established under the Modified Accelerated Cost Recovery System, allowing for faster depreciation of assets for tax purposes.

Property

Assets owned by an individual or business, which can include physical items like real estate and equipment, or intangible items like intellectual property.

MACRS

The Modified Accelerated Cost Recovery System, a method of depreciation used for tax purposes in the United States allowing faster depreciation.

Q1: Bretthauer Corporation has provided data concerning the

Q37: A manufacturing company uses a standard costing

Q55: The following direct labor standards have been

Q55: Comco, Inc. has accumulated the following data

Q63: The curve that shows the change in

Q70: The four tasks that follow take place

Q83: Acton Corporation, which applies manufacturing overhead on

Q85: An outdoor barbecue grill manufacturer has a

Q88: The following accounts are from last year's

Q100: Eddy Corporation has provided the following production