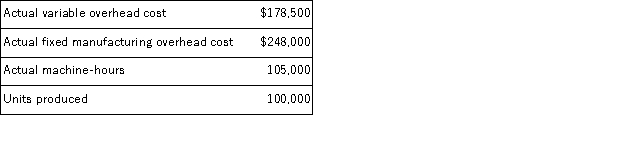

Littleton Manufacturing uses a standard cost system in which manufacturing overhead is applied to units of product on the basis of standard machine-hours. At standard, each unit of product requires one machine-hour to complete. The standard variable overhead is $1.80 per machine-hour and $432,000 per year. The denominator level of activity is 120,000 machine-hours, or 120,000 units. Actual data for the year were as follows:  Required:

Required:

a. What are the predetermined variable and fixed manufacturing overhead rates?

b. Compute the variable overhead rate and efficiency variances.

c. Compute the fixed manufacturing overhead budget and volume variances.

Definitions:

Nationalistic

Related to advocating for or demonstrating strong support and pride in one's country, often at the expense of disregarding international considerations.

Military Goods

Military goods are products and services designed specifically for use by armed forces, including weapons, equipment, and support services.

External Cost

Costs incurred by a third party who did not agree to the action causing the cost, typically associated with environmental, health, and social impacts.

Equitable Distribution

The fair and impartial division of resources or wealth among all members of a society.

Q13: Garage Specialty Corporation manufactures joint products

Q15: Lassie Company uses cost-plus pricing and has

Q22: Which of the following methods should be

Q28: An outdoor barbecue grill manufacturer has a

Q56: The Modified Accelerated Cost Recovery System (MACRS)

Q57: Messana Corporation reported the following data for

Q59: The following data pertains to activity and

Q60: Stenquist Corporation has provided the following data

Q88: The following data pertain to Darrell Industries:<br>Interest

Q88: Which of the following project evaluation methods