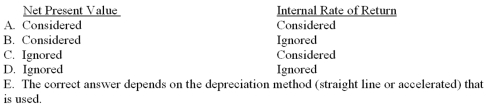

If income taxes are ignored, which of the following choices correctly notes how a project's depreciation is treated under the net-present-value method and the internal-rate-of-return method?

Definitions:

Special Journals

Customized accounting journals used for recording specific types of transactions in detail, such as sales or purchases.

Cash Receipts Journal

An accounting journal specifically for all cash inflows or receipts, including sales, loan proceeds, and interest earned.

Current Asset

Assets that are expected to be converted into cash, sold, or consumed within one year or within the operating cycle of the business, whichever is longer.

LIFO Cost Assumption

The LIFO Cost Assumption is a principle used in the LIFO inventory valuation method, assuming that the most recently acquired items are the first to be sold, impacting the reported income and inventory costs.

Q13: If the actual direct labor-hours used is

Q18: Young Corporation has a high probability

Q24: Harkey Corporation's balance sheet and income statement

Q25: A partial listing of costs incurred during

Q45: Consider the following statements about service department

Q47: Acuff Corporation applies manufacturing overhead to products

Q52: Snyder, Inc., which has excess capacity,

Q52: Economic value added:<br>A) is a dollar amount

Q91: The difference between budgeted fixed manufacturing overhead

Q163: Which of the following costs is classified