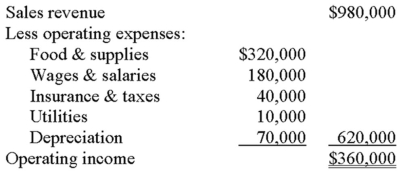

Cones & Moore sells frozen custard and sandwiches. It is considering a new site that will require a $2 million investment for land acquisition and construction costs. The following operating results are expected:

Disregard income taxes.

Required:

A. If management requires a payback period of four years or less, should the new site be opened? Why?

B. Compute the accounting rate of return on the initial investment.

C. What significant limitation of payback and the accounting rate of return is overcome by the net-present-value method?

Definitions:

360-Day Year

A conventional method in finance where the year is assumed to have 360 days for simplifying interest rate calculations, commonly used in commercial lending.

Exact Simple Interest

Interest calculated based on the actual number of days in the loan period divided by the exact number of days in a year, typically 365 or 366.

365-Day Year

A conventional method used in finance that assumes all years have 365 days for the purpose of interest calculation.

Exact Simple Interest

Interest calculated precisely on the principal amount, without compounding, for a specific time period.

Q2: Cuda Manufacturing Corporation uses a standard cost

Q26: Lead indicators guide management to:<br>A) take actions

Q35: Jaycee Manufacturing, which produces electrical components,

Q40: Enwall Corporation's standard wage rate is $11.20

Q60: Algeria Transport Company has average invested capital

Q71: Smithville uses labor hours to apply variable

Q72: A flexible budget is appropriate for a(n):

Q85: Factors in a decision problem that cannot

Q85: The following selected information was extracted from

Q169: Frank Company operates a cafeteria for its