Baker, Inc. produces a number of components that are used in home theater systems. Fred Briggs, head of the company's market research department, has identified the need for a new component that will most likely sell for $75. Projected volume levels are anticipated to reach 28,000 units in the first year, as several firmly entrenched competitors will be introducing a similar product in the not-too-distant future.

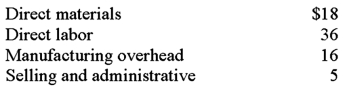

Conversations with Baker's engineers and reviews of cost accounting data related to similar products that the company manufactures resulted in the following cost estimates for the new component:

Baker currently uses cost-plus pricing and adds a 20% markup on total production cost to arrive at what is normally a competitive selling price.

Required:

A. What is the anticipated selling price of the new component if Baker uses its current pricing policy? What difficulties, if any, might the company face in the marketplace?

B. Assume that Baker decides to switch to target costing. What price would the company charge for the new component?

C. With the switch to target costing, what would Baker have to do to the component's manufacturing cost to achieve the normal profit margin on sales? Be specific and show calculations.

Definitions:

Chronic Bronchitis

A long-term inflammation of the bronchial tubes that results in persistent coughing and production of sputum.

Frequency Adjustment

The process of altering the rate or pitch of audio elements or electronic signals, commonly applied in medical devices, broadcasting, and sound production.

Aerosol Drug

Medication delivered in the form of a mist inhaled into the lungs, typically used for respiratory conditions.

Huff Coughs

A technique of coughing with an open glottis that is less forceful than a normal cough, designed to move mucus up the airways.

Q3: Which of the following methods fully recognizes

Q8: Seymore Company has two service departments

Q12: A company's expected receipts from sales and

Q33: If the actual purchase price for materials

Q44: Listed below are five variances (and possible

Q54: Taylor Enterprises purchased 56,000 pounds (cost =

Q58: Tunley Corporation has excess capacity. If the

Q61: Which of the following would be considered

Q80: The following data relate to product no.

Q85: Factors in a decision problem that cannot