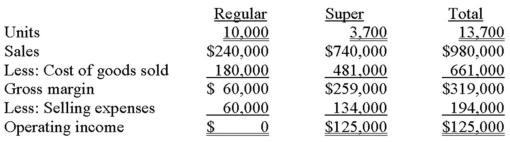

HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow.  Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

HiTech wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

Definitions:

Direct Ownership System

A system where assets are directly owned by individuals or entities, allowing for complete control and management of those assets.

Control

The process of monitoring activities to ensure they are being accomplished as planned and correcting any significant deviations.

Quality Levels

The standards or benchmarks set to measure the overall excellence or effectiveness of a product, service, or process.

Product-distribution Franchising

A franchising model in which the franchisee is granted the right to sell the franchisor's products, often including distribution rights in a specific territory.

Q10: An unfavorable labor rate variance is recorded

Q22: Verna's makes all sales on account, subject

Q29: Sales margin shows:<br>A) the amount of income

Q41: Consider the following statements about the step-down

Q48: The revenue curve shows the relationship between

Q50: Widman, Inc. makes and sells only one

Q59: Digregory makes all purchases on account, subject

Q64: Which of the following combinations of direct-material

Q75: The Razooks Company, which manufactures office

Q91: Nonprofit organizations begin their budgeting process with:<br>A)