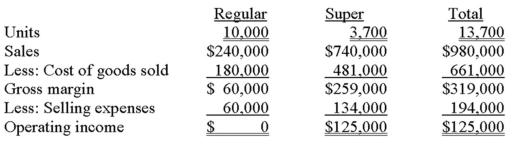

HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow.  Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Disregard the information in the previous question. If HiTech eliminates Regular and uses the available capacity to produce and sell an additional 1,500 units of Super, what would be the impact on operating income?

Definitions:

Specialization

The process of focusing resources on the activities that lead to the greatest efficiency and output in production or services.

Nations

Significant populations sharing a common ancestry, historical background, cultural practices, or language, living together in a specific nation or region.

Subsidies

Financial support provided by the government to individuals or businesses to lower the cost of goods and services or to support industry.

Olive Growers

Individuals or entities involved in the cultivation of olive trees and the production of olives for consumption or the extraction of olive oil.

Q1: All of the following are inventoried under

Q3: Mad's Hatters Corporation will evaluate a potential

Q4: Northcutt's production data for a new deluxe

Q9: Which of the following is the correct

Q44: Discuss the importance of budgeting and identify

Q48: Tillinghast Corporation estimates that its variable manufacturing

Q50: The Telemarketing Department of a residential remodeling

Q69: The variable-overhead spending and efficiency variances are:

Q70: A factory that makes a part has

Q91: Consider the following statements about absorption-cost pricing